Today’s data is relatively dense. The European market mainly focuses on the CPI of Germany in November. In the evening, the United States will release the pending housing sales of the United States in October and the Dallas Fed manufacturing activity index in November. The two-day OPEC Conference was officially held today. It is reported that the OPEC+informal meeting on Sunday failed to reach a consensus on whether to postpone the production increase plan, leaving it to the ministerial plenary meeting to make a decision at the beginning of this week. Therefore, we should pay close attention to the fluctuation of crude oil prices driven by the news during the meeting.

[Today’s financial data and events]

18:00 European Central Bank President Lagarde delivered a speech

21:00 Initial value of German November CPI monthly rate

21:30 Canada’s third quarter current account

22:45 Chicago PMI in November

23:00 US contract sales index of completed housing in October

23:30 Dallas Fed Business Activity Index in NovemberEURUSD: Spread 0-3

The euro recorded two consecutive gains against the US dollar last week and reached a new high since August. The exchange rate continued to hit a high in the morning. During the day, pay attention to the speech of European Central Bank President Lagarde at 18:00, and the Eurogroup meeting is also held today. You can pay attention to the news related to the economic outlook. In the data aspect, pay attention to the initial value of German CPI in November (expected slowdown). Technically, the exchange rate has broken through the top of the upward channel since November 11, refreshing the high level since September 1. If it can break through the initial resistance of 1.1985, the target is 1.2006 above the level of 1.20.

1.1985/1.2006 resistance, 1.1939/1.1919 support

GBP/USD: point difference 0-3

Sterling fell against the US dollar twice last Friday and recorded a four-day low, and rose in the morning. Brexit is about to enter the penultimate four weeks. The British Foreign Minister said on Sunday that it is expected that an agreement will be reached this week, which will rekindle the market’s hopes for an agreement and help drive the rebound of sterling. Technically, the fall of the pound last Friday was supported by the 10-day moving average, which was maintained above 1.3300. We should continue to focus on the high of 1.3397 last week as a key resistance, but also pay attention to the news from the Brexit side at any time. If the pound is negative, it may trigger the possibility of falling to 1.3278/1.3262 support.

1.3377/1.3397 resistance, 1.3278/1.3262 support

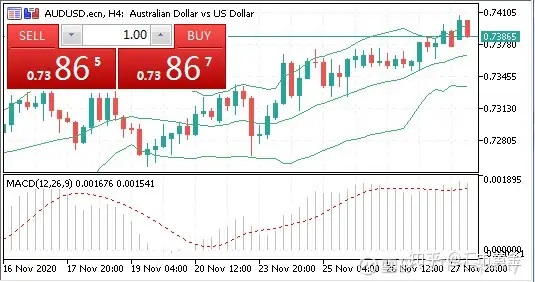

AUD/USD: point difference 0-3

The Australian dollar and the New Zealand dollar continued their upward trend against the US dollar last Friday, and both hit new highs this morning. The Australian dollar hit a new intraday high since September 1, while the New Zealand dollar also continued to hit a high for more than two years. Last week, it recorded four consecutive gains, the first since December last year. The current market sentiment is relatively good and is expected to continue to drive the rise. The technical side of the four-hour chart shows that both the Australian dollar and the New Zealand dollar have retreated after testing the resistance of the upward trend line since late November. If they can break through, it means that more upward space is open, but if they are blocked, they should pay attention to the high consolidation, while the current resistance of the Australian dollar/US dollar points to 0.7414/0.7428。纽元/美元偏向在0.7050下方的盘整,初步阻力暂时关注0.7065/0.7085,如果因遇阻回落需看向0.7016/0.7002支撑。

0.7414/0.7428阻力、0.7374/0.7354支持

美元兑日元:点差0-3

美元兑日元今早延续前两日的下行,盘中刷新11月23日的最低水平,跌破104关口,日本国内疫情未能受控,新增案例增加,日经指数下跌拖累美元兑日元下跌。技术上也跌破了10日均线,指向了11月18日低位,因此留意103.67带来的初步支撑,更低下望黄金调整位所在的103.42水平。

104.21/104.34阻力、103.67/103.42支持

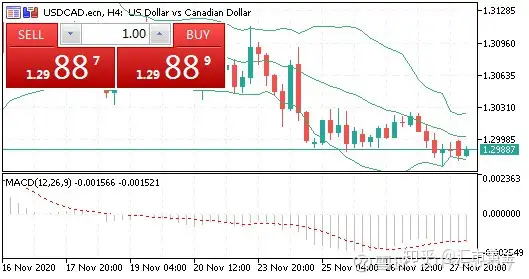

美元兑加元:点差0-3

美元兑加元上周五下探11月9日以来的低位,当前在低位徘徊。今日召开的OPEC+大会将是指引原油价格的关键,也会对加元带来重要指引。技术上汇价今早继续承压,但目前1.2080暂时提供支撑,如果能够守住则仍有机会反弹测试1.30阻力,看向1.3020/1.3048阻力。但如果跌破上述支撑则可能进一步测试1.2941及11月9日的低点所在的1.2928支撑。

1.3020/1.3048阻力、1.2941/1.2928支持

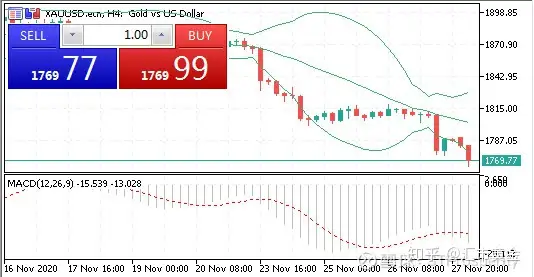

现货黄金:点差0.6-1.2

市场对于疫苗的乐观推升股市,上周五黄金加大下挫,盘中曾触及7月份以来的最低位至1774.20美元,周线创下9月25日以来当周以来最大跌幅。今早金价盘中继续承压,但道指期货向下有望提供支撑,金价暂时交投在1780美元上方,而1798/1801为初步阻力,支撑暂时看向上周低点附近的1775支撑,如果跌破可能看向更低的1772/1768美元。白银价格同样仍处于低位,需关注22.17/22.08支撑,阻力望向22.68/22.77。

1798/1801阻力、1775/1772支持

内容仅供参考:市场有风险,投资需谨慎。祝交易愉快