Some previously steadfast bears are showing signs of capitulating after the S&P 500’s multi-month rally approached key levels on technical charts.

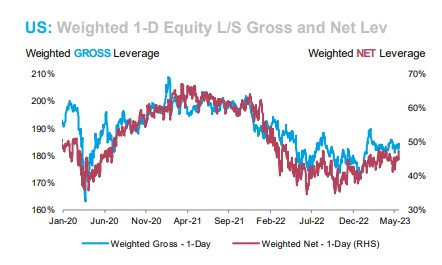

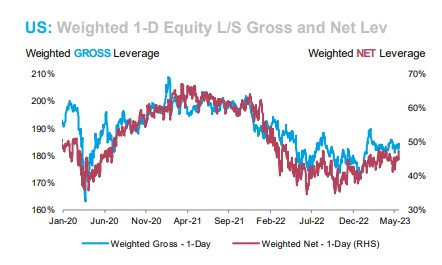

Long/short hedge funds snapped up U.S. stocks for two straight weeks, with total purchases reaching the highest level since October, according to data compiled by Goldman Sachs Group Inc.’s prime brokerage unit. In the five weeks prior to that, they continued to sell off. Morgan Stanley clients last week raised their net leverage to the highest level in 2023. It is a measure of risk appetite that takes into account long versus short positions.

After a $3 trillion stock market rally this year, the resolve of bears is fading, and everything from banking turmoil to falling profits and now a possible U.S. default is seen as bearish for stocks. Substantial blow. Instead, their growing concern about missing out on profit opportunities may have led to a reconsideration of defensive positions. Some believe that defensive positioning has set the stage for a rally in stocks since October.

In signs that the bear market retreat is not just a U.S. phenomenon, Japan’s Topix surged to its highest level since 1990 and the Stoxx Europe 600 Index hovered near a 15-month high . Among long/short hedge funds globally, net leverage has risen to the highest level since last August, according to JPMorgan.

The latest bout of demand pushed the S&P 500 out of one of its tightest trading ranges in years after being stuck in a tight 140-point range for as long as six weeks. However, the index has yet to actually break above the much-watched 4,200 level. As of last Friday, the index broke through the mark for two consecutive sessions, but failed to hold. On Monday, the index fluctuated around that level again. Tony Pasquariello, head of Goldman Sachs’ hedge fund practice, told clients to take some profit-taking after witnessing traders suddenly scrambling for “right tail protection.” “Right-tail protection” usually refers to buying call options when the market has risen sharply.