Spot gold rose first and then fell this week as a whole, and the fear of the US debt ceiling impasse boosted the demand for safe haven. Wednesday’s lower than expected CPI data pushed gold up to near the 2050 level in the short term. However, given that Federal Reserve officials still emphasize the stickiness of inflation and the rebound in the US dollar, gold closed lower for two consecutive days and remained stable on Friday after taking back all gains from this week. Spot silver is under even greater pressure due to economic concerns that may disrupt physical demand. It fell more than 4% on Thursday, falling below the $24 mark and hitting a new low since April 4th.

The US dollar, as the number one safe haven currency, also benefited from the US debt ceiling crisis and the pressure on the banking sector. This week, the US dollar index is expected to record its biggest weekly increase since February. The yield performance of US bonds was differentiated. The yield of 10-year US bonds declined due to signs of economic slowdown, while the yield of short-term US bonds remained high due to increased risk of debt default, leading to the deepening of the inverted Yield curve of US bonds.

Under the pressure of the strengthening US dollar, non US currencies generally closed lower this week. The euro fell to its lowest point against the US dollar since April 11th on Thursday, and the decline further deepened on Friday, falling below 1.09. The pound briefly rose against the US dollar after the Bank of England interest rate decision, and then resumed its decline.

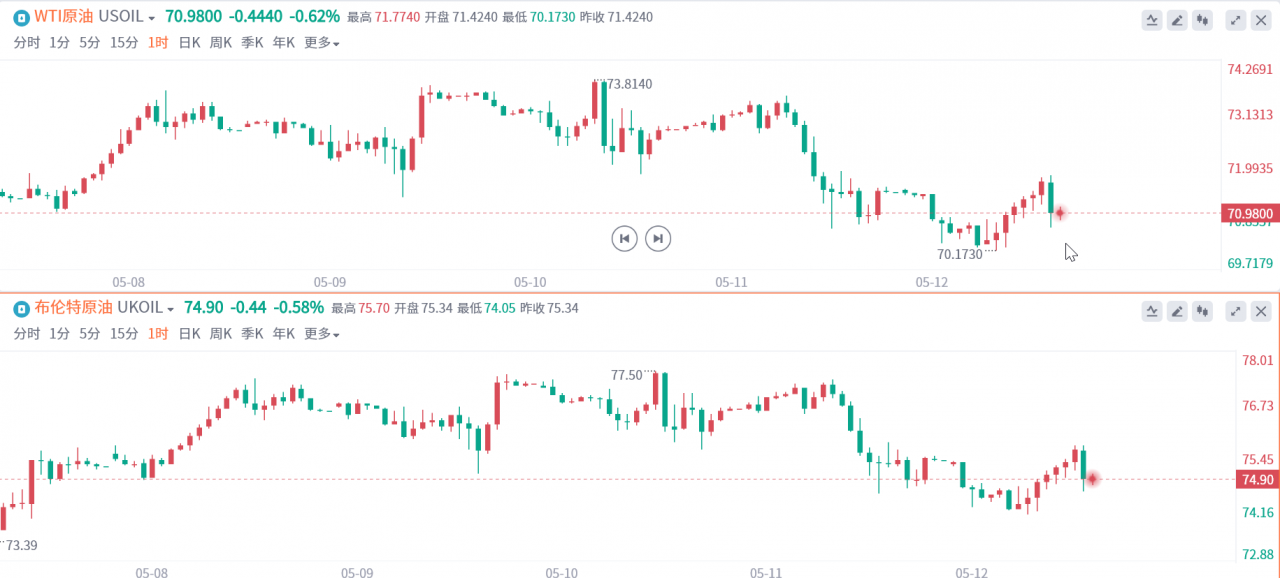

This Wednesday’s US initial employment data released a weak signal in the job market, putting pressure on the outlook for crude oil demand once again. The two oil companies wiped out all the gains from the beginning of the week and are set to close down for the fourth consecutive week. WTI crude oil remained stable above the $70 level on Friday. The speculation that the United States may replenish its strategic oil reserves has provided some support for oil prices.

The US stock market is struggling to survive multiple risks such as a cooling of the US job market, debt ceiling deadlock, and new concerns about the health of regional banks. Friday’s unexpected rise in long-term inflation expectations brought another blow. The Dow has fallen for four consecutive trading days, and both the S&P 500 and the Dow will record their second consecutive week of decline. Technology stocks continue to outperform the broader market, and payrolls are still expected to rise for the third consecutive week.