NARRATIVE TAKING SHAPE…

The Euro has been trading stronger in recent days as speculations swirls that the Russian invasion of Ukraine is close to ending. As talks progress towards a ceasefire, the proverbial toothpaste is being back in the tube: no more commodity supply chain disruptions; no more funding stresses in financial markets; no more uncertainty about the economic fallout.

Against this backdrop of dissolving concerns, traders have begun to position themselves as if the European Central Bank will not have significant uncertainty to deal with as it moves to withdraw stimulus and tighten monetary policy later this year. Indeed, should the Russo-Ukrainian war end, it stands to reason that the ECB will act more quickly to tame inflation pressures sooner than 4Q’22, where market pricing stood prior to this week. Rate differentials, which had favored a weaker Euro relative to the British Pound and the US Dollar, have begun to swing back in the Euro’s favor.

EUR/USD RATE TECHNICAL ANALYSIS: DAILY CHART (MARCH 2020 TO MARCH 2022) (CHART 1)

EUR/USD rates have moved above 1.1120, former support in a sideways range that was carved out between January and February. In doing so, a meaningful bottom may have been formed after the pair briefly fell to the ascending trendline from the 2000 and 2017 lows. Resistance is already achieved, with EUR/USD rates trading higher into the descending trendline from the May 2021, September 2021, and January 2022 swing highs. A ‘buy the dip’ mentality may be appropriate in EUR/USD rates so long as the pair stays above 1.1120.

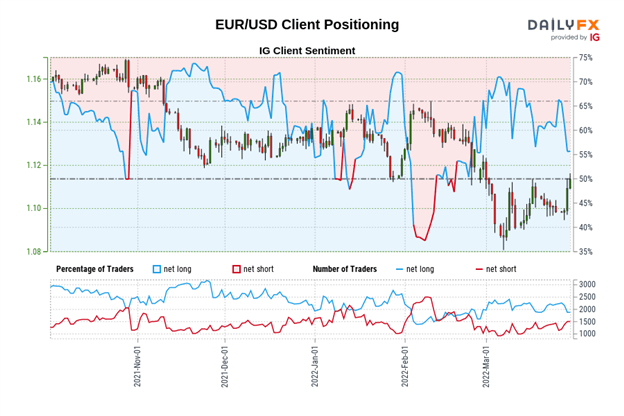

IG CLIENT SENTIMENT INDEX: EUR/USD RATE FORECAST (MARCH 30, 2022) (CHART 2)

EUR/USD: Retail trader data shows 55.18% of traders are net-long with the ratio of traders long to short at 1.23 to 1. The number of traders net-long is 9.01% lower than yesterday and 15.82% lower from last week, while the number of traders net-short is 10.49% higher than yesterday and 2.22% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.