GOLD, DAX, CRUDE OIL, UKRAINE, RUSSIA – TALKING POINTS:

- Gold prices steady at range support on souring Ukraine de-escalation hopes

- Brent crude oil futures spread widens on resurfacing supply disruption fears

- Germany’s DAX stock index recoils from resistance, hints topping underway

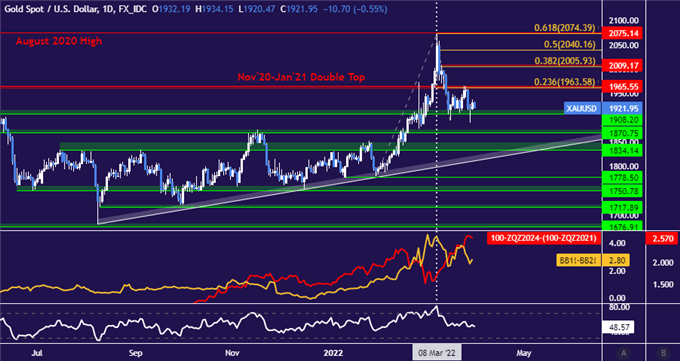

Gold prices steadied at ranged support anchored at 1908.20 as hopes for a breakthrough in negotiations between Russia and Ukraine appeared to sour. The two sides left a meeting in Istanbul empty-handed earlier this week, with follow-on comments from Moscow seemingly aimed at moderating expectations.

At the same time, the markets appeared wary of the Kremlin’s claim of pulling back troops from Kyiv, Ukraine’s capital. Western intelligence described the movements as repositioning rather than a drawdown, and heavy shelling continued elsewhere. The mayor of Chernihiv said a humanitarian crisis looms, for example.

A bounce from here eyes range resistance at 1965.55. Securing a foothold above that may set the stage for a challenge of the $2000/oz figure. Alternatively, slipping below range support at 1908.20 sees the next key downside barrier at 1870.75. Retesting $1800/oz seems needed to mark a lasting bearish turn, however.

Gold price chart created using TradingView

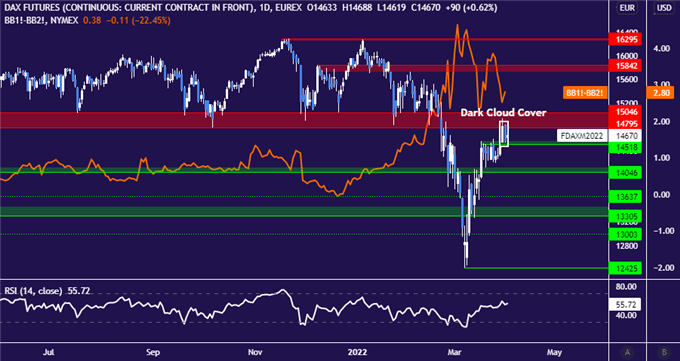

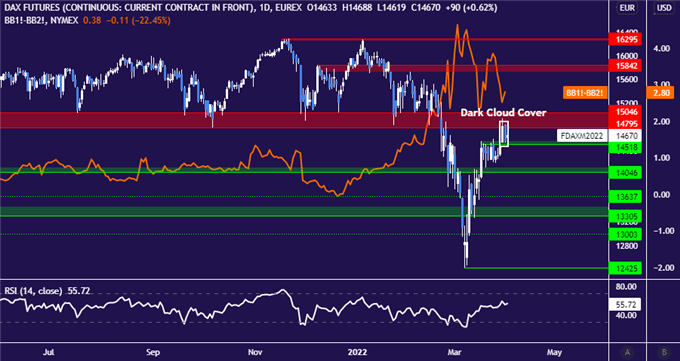

Meanwhile, Germany’s benchmark DAX stock index pulled away from major support-turned-resistance clustered near the 15000 figure as Ukraine-related worries perked up. It has been trading inversely of the Brent crude oil futures spread, which tellingly ticked up as supply disruption risk returned to the spotlight.

Prices have now formed a bearish Dark Cloud Cover candlestick pattern, which may mark topping and precede a reversal lower. Preliminary confirmation calls for a daily close below support anchored at 14518, which may clear the way for a probe the 14000 figure. Alternatively, breaking above 15046 may expose 15842 next.